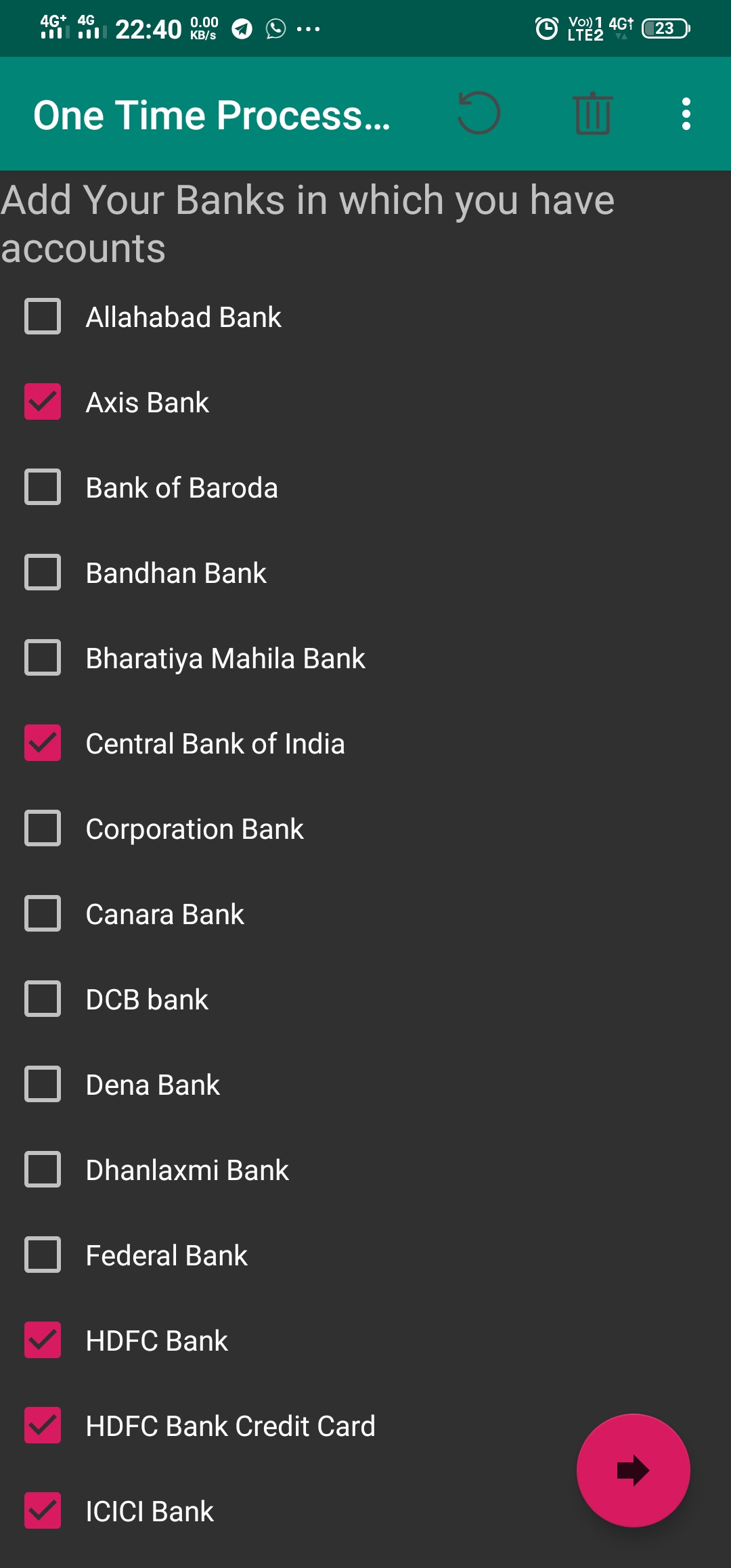

Every day, millions of us effortlessly tap or insert our credit cards to make purchases. It’s become such a routine action that we rarely pause to consider the intricate dance of data and advanced technology happening within that tiny plastic rectangle. But peel back the surface, and you’ll discover that the unassuming metallic square on your card is far more than just a contact point – it’s a powerhouse of innovation, a miniature computer silently working to safeguard your financial life.

It’s easy to dismiss it as mere magic, a seamless transaction facilitated by an invisible force. However, the reality is a testament to cutting-edge engineering and robust cybersecurity principles. That little chip isn’t simply holding your card number; it’s a sophisticated guardian, running complex algorithms and generating unique digital keys with every single use. It’s a tiny fortress of security, tucked right into your wallet.

Want a quick visual rundown of this incredible technology? We’ve put together a short video that brings this tech marvel to life:

Table of Contents

The Evolution of Payment Security: From Swipes to Smart Chips

For decades, credit card transactions relied on the magnetic stripe – a simple, static storage method for your card details. While convenient for its time, this technology was inherently vulnerable. Skimming devices could easily copy the data, leading to widespread fraud. The need for a more secure alternative became glaringly apparent, paving the way for the EMV chip.

EMV, an acronym for Europay, MasterCard, and Visa (the companies that originally created the standard), represents a global shift in payment card technology. Introduced to enhance security and prevent counterfeiting, the EMV chip transformed the credit card from a simple data carrier into an active participant in the transaction, capable of dynamic authentication.

At the Heart of the Chip: A Miniature Computer

That shiny metallic square on your card isn’t just a conduit; it’s literally a microprocessor – a tiny, specialized computer. Think of it as having its own central processing unit (CPU), read-only memory (ROM) for its operating system and fixed data, random-access memory (RAM) for temporary calculations, and non-volatile memory (EEPROM or Flash) for storing encrypted cardholder data and transaction logs. This robust architecture enables the chip to perform complex cryptographic operations in real-time.

When you insert your card into a terminal or tap it, you’re not just passing information; you’re initiating a secure handshake between two computers. The chip’s operating system, often a highly specialized secure OS, orchestrates this entire process, managing communication with the terminal and executing the intricate security protocols necessary for authentication.

The Cryptographic Fortress: How Your Data Stays Secure

This is where the true magic of the EMV chip unfolds: its ability to generate dynamic data. Unlike the static data on a magnetic stripe, the EMV chip doesn’t simply transmit your card number. Instead, for every single transaction, it creates a unique, one-time use cryptogram.

The Power of One-Time Cryptograms

Imagine a secret handshake that changes every time you meet someone. That’s essentially what a cryptogram is. Here’s how it works:

- Mutual Authentication: When you insert or tap your card, the terminal and the chip authenticate each other to ensure they are both legitimate parties.

- Dynamic Data Generation: The chip takes several pieces of information – the transaction amount, date, time, and a unique, random number generated by the terminal – and combines them with highly sensitive card data (which never leaves the chip in plain text) using complex encryption algorithms.

- Unique Cryptogram Output: This process generates a unique cryptogram. This cryptogram is effectively a digital signature for that specific transaction.

- Verification: The cryptogram is then sent along with other transaction details to the bank for verification. The bank, using a shared secret key (derived from a master key on the chip), can verify that the cryptogram was indeed generated by your genuine card for that specific transaction.

This dynamic authentication process makes it incredibly difficult for fraudsters. Even if a thief somehow manages to intercept the transaction data, the unique cryptogram is useless for future transactions because it was valid only for that single payment. This significantly reduces the threat of counterfeit card fraud and data breaches.

The Invisible Handshake: Near Field Communication (NFC)

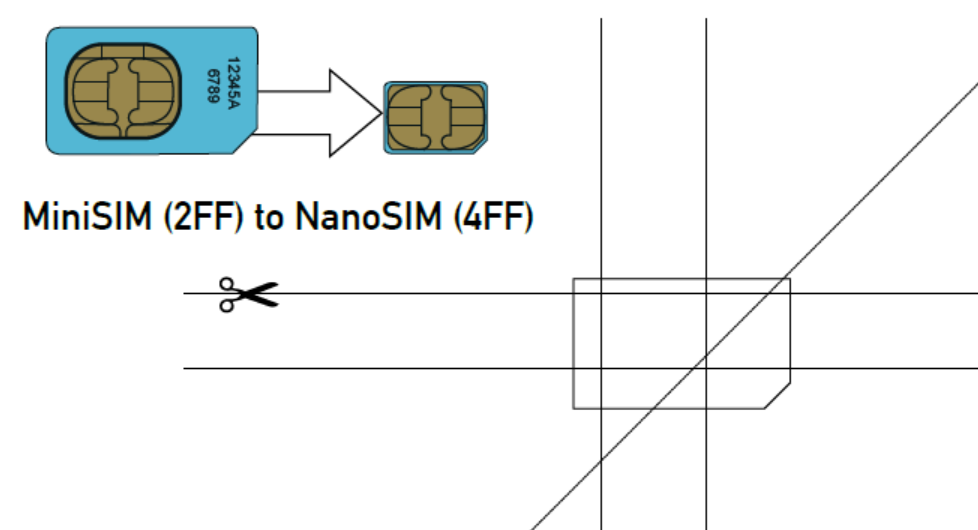

For those lightning-fast contactless payments, the EMV chip integrates Near Field Communication (NFC) technology. This isn’t a separate security system; it’s simply a different way for the chip to communicate with the payment terminal, leveraging the same robust EMV security protocols.

NFC works through electromagnetic induction. When your card is brought within a few centimeters (typically 1-2 inches) of an NFC-enabled terminal, a magnetic field is created between the two devices. This field powers the tiny antenna and chip inside your card, allowing it to securely transmit encrypted data wirelessly in milliseconds. It’s important to note that the very short range of NFC itself acts as a security feature, minimizing the risk of accidental data capture or ‘eavesdropping’ from a distance.

Just like chip-and-PIN transactions, contactless payments generate a unique cryptogram for each transaction. In many modern implementations, this also involves tokenization, where your actual card number is replaced with a unique, randomized ‘token’ for that transaction, adding another layer of security and further isolating your sensitive data.

The Global Standard: EMVCo and Interoperability

The widespread adoption and success of EMV technology are largely thanks to EMVCo, an organization jointly owned by six major payment networks: American Express, Discover, JCB, MasterCard, UnionPay, and Visa. EMVCo develops and maintains the EMV specifications, ensuring that chip cards and terminals from different manufacturers and banks around the world can communicate and operate seamlessly and securely.

This standardization is crucial for global interoperability, meaning your EMV card issued in one country will work securely in another, regardless of the bank or terminal vendor. It also promotes a consistent level of security across the entire payment ecosystem, making it harder for fraudsters to exploit weak links.

Protecting Your Digital Wallet: Why This Technology Matters

The advanced tech inside your credit card chip isn’t just about cool features; it’s about significant benefits for everyone involved:

- Enhanced Fraud Prevention: The primary benefit is the dramatic reduction in counterfeit card fraud. Since each transaction generates a unique cryptogram, stolen card data from a chip transaction is rendered useless for creating fake cards.

- Increased Security for Consumers: You can pay with greater peace of mind, knowing your financial data is protected by multiple layers of encryption and dynamic authentication.

- Global Acceptance: Thanks to EMV standards, your chip card is widely accepted and secure almost anywhere in the world.

- Future-Proofing Payments: The chip platform is versatile, capable of supporting additional features like biometrics (fingerprint sensors on cards) and advanced loyalty programs, paving the way for even more secure and convenient payment experiences.

Frequently Asked Questions About Credit Card Chips

Q1: Are EMV chip cards completely unhackable?

A: While no technology is absolutely impervious to all forms of attack, EMV chip cards are significantly more secure than magnetic stripe cards. Their dynamic data generation makes them highly resistant to common forms of counterfeiting and skimming. Sophisticated attacks are theoretically possible but require immense resources and are far less practical for mass fraud.

Q2: What happens if my chip is damaged or not working?

A: Most EMV cards still retain a magnetic stripe as a fallback option. If the chip is damaged or a terminal doesn’t support chip technology, the transaction might revert to a magnetic stripe read. However, these fallback transactions are less secure and may sometimes be declined by banks for higher-risk transactions.

Q3: Is contactless (NFC) payment less secure than inserting my chip card?

A: No, contactless payments using NFC leverage the exact same underlying EMV chip technology and its strong cryptographic security. The data transmitted wirelessly is encrypted and generates a unique cryptogram for each transaction, just like a contact chip transaction. The short range of NFC also adds a layer of physical security.

Q4: Does the chip store all my personal data, like my name and address?

A: The chip primarily stores encrypted card details necessary for transaction processing, such as your Primary Account Number (PAN), card expiry date, and cryptographic keys. It generally does not store sensitive personal information like your name, address, or transaction history in an easily accessible format, nor is it designed to track your purchases.

Q5: How can I tell if my card has an EMV chip?

A: Look for the small, square metallic chip embedded on the front of your credit or debit card, usually on the left side. It’s distinct from the magnetic stripe on the back.

The Guardians in Your Wallet

The next time you make a payment, take a moment to appreciate the unsung hero nestled within your wallet. That credit card chip isn’t just a piece of plastic; it’s a testament to continuous innovation in cybersecurity, a compact guardian leveraging complex algorithms and secure communication protocols to protect your hard-earned money. It’s a silent, powerful ally in the everyday battle against financial fraud, ensuring that your taps and swipes remain secure, seamless, and truly smart. In silicon’s heart, a guardian sleeps, a fortress of code, secrets it keeps – a marvel indeed!