Table of Contents

Podcast:

We sat down with our in-house Blockchain expert over a coffee and discussed in detail. Given below is the podcast of the same. Listen to it if you don’t wanna go through loads and loads of text detailed under.

Bridging the Physical and Digital: A Thorough Look at Real-World Asset Tokenization

The world of finance is constantly evolving, and one of the most compelling developments in recent years has been the emergence of real-world asset (RWA) tokenization. This innovative process is capturing the attention of industries ranging from finance to real estate, promising to unlock new levels of efficiency and accessibility. Imagine transforming tangible assets into digital tokens on a blockchain, making them more liquid, divisible, and transparent. This is the core of RWA tokenization, and its potential to reshape how we interact with and invest in assets is immense. Let’s delve deeper into this fascinating sector and explore its intricacies.

1. Defining the Digital Representation: What is Real-World Asset Tokenization?

At its heart, real-world asset (RWA) tokenization is the process of converting ownership rights of physical or tangible assets into digital tokens on a blockchain. Think of it as creating a digital representation, a “digital twin,” of an asset that exists in the real world. This digital token represents your claim to that asset, or a fraction of it, and can be traded, divided, or used in various decentralized finance (DeFi) applications. Unlike traditional methods of owning assets, tokenization deals with the intangible ownership rights rather than the physical asset itself. This allows for the division of high-value assets into smaller, more affordable units, making them accessible to a wider range of individuals.

These digital tokens can be either fungible or non-fungible, depending on the nature of the underlying asset. Fungible tokens are interchangeable, meaning each token has the same value and can be readily exchanged with another, much like shares in a company or fractional ownership of real estate where each token represents a percentage of the property. On the other hand, non-fungible tokens (NFTs) represent unique, indivisible assets, such as a specific piece of art or a luxury car. The ability to represent different types of assets in these digital forms opens up a vast array of possibilities. Industry projections, such as the one by Boston Consulting Group (BCG) estimating the market to reach $16 trillion by 2030 , underscore the significant growth potential and increasing institutional interest in this transformative sector.

Q&A with Blockchain Expert:

Blog Author: “So, it’s like taking a real thing and giving it a digital passport on the blockchain? But I’m still a bit unclear on what exactly gets ‘tokenized’ – is it the asset itself or just the ownership?”

Expert Response: “Think of it more like tokenizing the title or share of ownership. The physical asset remains where it is, but the blockchain token represents your right to that asset or a fraction of it. It’s the ownership that becomes liquid and easily transferable.”

2. Unlocking New Possibilities: Benefits and Applications of RWA Tokenization Across Industries

The tokenization of real-world assets brings forth a multitude of advantages that address long-standing limitations in traditional asset markets. One of the most significant benefits is increased liquidity. Traditionally illiquid assets like real estate or fine art, which can take significant time and effort to buy or sell, become more easily tradable when represented as digital tokens. Investors can buy and sell fractions of these assets quickly and efficiently, unlocking capital that would otherwise be tied up.

Furthermore, tokenization enables fractional ownership , significantly lowering the barrier to entry for investors. High-value assets that were once only accessible to institutional investors or the very wealthy can now be owned by a broader audience, as individuals can purchase small fractions of properties, artworks, or other valuable items. This democratization of investment opportunities can lead to more inclusive financial participation.

The use of blockchain technology also ensures enhanced transparency. All transactions are recorded on an immutable and auditable ledger, increasing investor confidence and reducing the possibility of fraud and ownership conflicts. Moreover, smart contracts, which are integral to the tokenization process, lead to operational efficiency and reduced costs by automating processes such as compliance checks, dividend distribution, and settlement, thereby minimizing the need for intermediaries and lowering administrative overhead. This automation also contributes to faster transaction speeds compared to traditional methods that often involve lengthy paperwork and manual processes.

Tokenization also offers opportunities for portfolio diversification by allowing investors to include previously inaccessible asset classes in their investment strategies. Finally, asset programmability through smart contracts enables automated features like automated compliance checks, dividend distributions, and governance mechanisms, adding a new layer of functionality to traditional assets.

The applications of RWA tokenization span a wide array of industries. In real estate, tokenization allows for fractional ownership of residential and commercial properties, making it possible for more people to invest in this traditionally capital-intensive market. Commodities like gold, oil, and agricultural products can be tokenized, providing a more efficient and accessible way to trade these resources. The art world is also being transformed, with art and collectibles being tokenized to enable fractional ownership and increased liquidity in this market. Financial instruments such as bonds, stocks, and other traditional securities are also being tokenized, leading to greater efficiency and accessibility in capital markets. Even intellectual property like royalties from music, patents, and trademarks can be tokenized, providing creators with new ways to monetize their work. The possibilities are truly vast, extending to luxury goods, insurance policies, loans, renewable energy infrastructure, and much more. Real-world examples like the tokenization of the St. Regis Aspen Resort for fractional ownership and the tokenized commodity finance fund by TradeFlow demonstrate the practical realization of these benefits.

Q&A with Blockchain Expert:

Blog Author: “It sounds great on paper, but are these benefits actually being realized in the real world? Can you give me some examples of successful applications?”

Expert Response: “Absolutely. We’re already seeing real-world examples like the St. Regis Aspen Resort being tokenized for fractional ownership, companies like TradeFlow tokenizing commodity trade portfolios, and even major institutions like Blackrock and Franklin Templeton launching tokenized mutual funds. These show the practical application and growing adoption.”

Table: Benefits of RWA Tokenization

| Benefit | Description |

| Increased Liquidity | Traditionally illiquid assets become easier to buy and sell. |

| Fractional Ownership | Allows multiple investors to own a portion of a high-value asset. |

| Enhanced Transparency | Transactions are recorded on an immutable and auditable blockchain. |

| Operational Efficiency | Smart contracts automate processes, reducing the need for intermediaries. |

| Reduced Costs | Lower administrative and transaction fees due to automation and fewer intermediaries. |

| Faster Transaction Speeds | Transactions can be completed more quickly compared to traditional methods. |

| Portfolio Diversification | Enables investment in previously inaccessible asset classes. |

| Asset Programmability | Smart contracts allow for embedding rules and functionalities directly into the tokenized asset. |

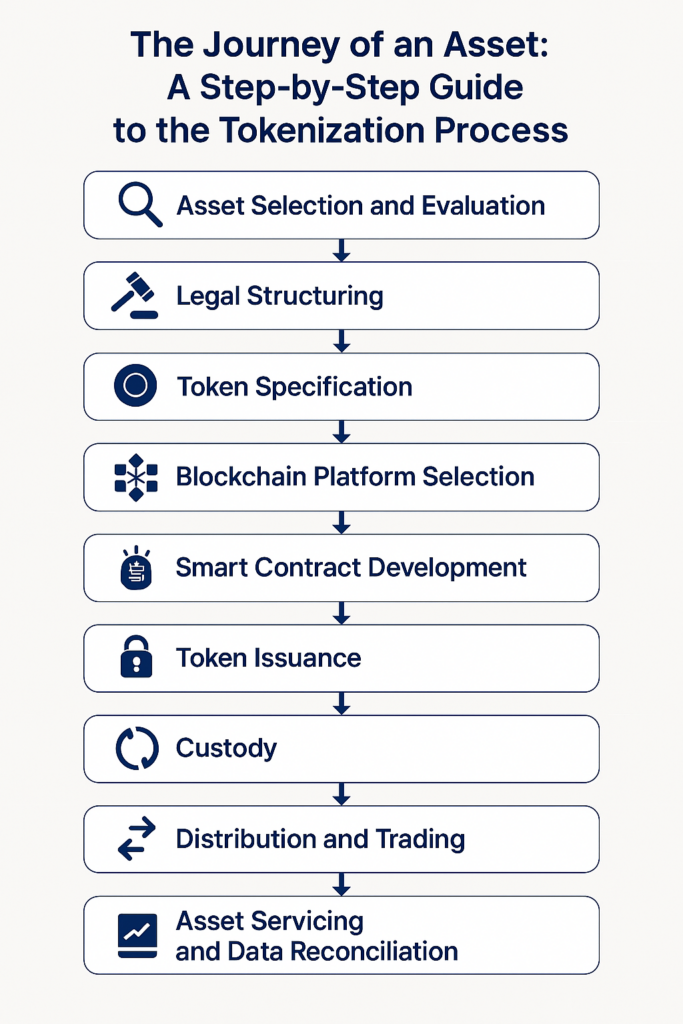

3. The Journey of an Asset: A Step-by-Step Guide to the Tokenization Process

The process of tokenizing a real-world asset typically involves several key stages. It begins with asset selection and evaluation , where the asset to be tokenized is identified, and its suitability and value are carefully assessed. This includes considering the legal structure of the asset and any potential restrictions on ownership. Following this, legal structuring is crucial to establish the legal framework for the tokenization project and define the rights associated with the tokens. A key aspect here is determining whether the token will be classified as a security, which has significant regulatory implications. The appropriate tokenization structure, such as a Tokenized Special Purpose Vehicle (SPV) or direct asset tokenization, is also chosen at this stage.

Next comes token specification , where the characteristics of the token are defined, including whether it will be fungible or non-fungible, the token standard to be used (e.g., ERC-20, ERC-721 on Ethereum, SPL on Solana), and other fundamental parameters. The selection of the blockchain platform is another critical step, with factors like scalability, transaction costs, security, and the specific requirements of the tokenized asset influencing this decision. Once these foundational elements are in place, smart contract development takes place, where the self-executing contracts that will govern the tokens and the rights associated with the underlying asset are created.

With the smart contracts ready, the process moves to token issuance (minting) , where the digital tokens are generated on the chosen blockchain network. Custody of the underlying asset is also a crucial consideration, ensuring its secure storage and management. Following issuance, the tokens need to be made available to investors through distribution and trading , which can involve primary offerings and listings on secondary markets. Finally, asset servicing and data reconciliation involve the ongoing management of the tokenized asset, including regulatory reporting, tax considerations, and accounting. For many tokenized assets, especially those backed by off-chain collateral, integrating real-world data with the on-chain tokens through off-chain connections using oracles is essential for maintaining transparency and accuracy.

Q&A with Blockchain Expert:

Blog Author: “This seems like a lot of steps. Is it really this complicated for every asset?”

Expert Response: “The complexity can vary depending on the type of asset and the desired outcome. For instance, tokenizing a simple commodity might be less complex than fractionalizing a piece of real estate with complex legal ownership. However, the fundamental steps generally remain the same to ensure legitimacy and compliance.”

4. Governing the Digital Realm: Legal and Regulatory Frameworks for Tokenized Assets

Navigating the legal and regulatory landscape is a critical aspect of real-world asset tokenization. The regulatory frameworks governing this sector are still evolving and often lack global uniformity, creating a degree of uncertainty for those involved. In many jurisdictions, tokenized assets are treated as securities , which means they must comply with existing securities regulations regarding issuance, trading, and investor protection. In the United States, for example, the Securities and Exchange Commission (SEC) applies the Howey Test to determine whether a token qualifies as an investment contract and thus a security.

Compliance with Anti-Money Laundering (AML) and Know Your Customer (KYC) regulations is also paramount to prevent financial crimes and ensure the integrity of the financial system. Additionally, data privacy considerations, such as the General Data Protection Regulation (GDPR) in Europe, must be taken into account when handling investor data.

The regulatory landscape varies significantly across different countries. In the United States, the SEC is the primary regulator for tokenized assets deemed securities, while the Commodity Futures Trading Commission (CFTC) may oversee tokenized commodities. Recent legislation like the Lummis-Gillibrand Act and the Digital Commodity Exchange Act aim to provide more clarity in this space. The European Union has introduced the Markets in Crypto-Assets (MiCA) regulation to create a unified framework for crypto-assets, including tokenized RWAs, across member states. Several jurisdictions in Asia, such as Singapore, Hong Kong, and Japan, have been proactive in establishing regulatory frameworks to facilitate the growth and adoption of tokenization.

To navigate this complex regulatory environment, several compliance strategies can be adopted. Conducting a thorough legal assessment to determine the classification of the asset and the applicable laws is essential. Engaging legal experts who specialize in blockchain and financial regulations is crucial for understanding and adhering to these requirements. Incorporating compliance features directly into the token and the tokenization platform, such as automated KYC/AML processes, is also a key step. Finally, partnering with regulated entities like licensed exchanges and custodians can enhance compliance capabilities and provide additional credibility to tokenization projects.

Q&A with Blockchain Expert:

Blog Author: “The regulatory side seems daunting. Where should someone even start to figure out the rules for their specific asset?”

Expert Response: “The first crucial step is to consult with legal experts who specialize in blockchain and financial regulations in your specific jurisdiction. They can help you assess how your asset will be classified and what regulations you need to comply with.”

Table: Regulatory Landscape Snapshot (Key Jurisdictions)

| Jurisdiction | Key Regulatory Bodies | Current Regulatory Approach |

| United States | SEC, CFTC, FinCEN | Applying existing securities and commodities laws, with recent legislative efforts to provide more clarity. |

| European Union | ESMA, National Authorities | MiCA regulation provides a unified framework for crypto-assets, including tokenized RWAs. |

| Singapore | Monetary Authority of Singapore (MAS) | Proactive in setting clear guidelines for security token issuance and establishing a regulatory sandbox. |

| Hong Kong | Securities and Futures Commission (SFC) | Actively exploring asset tokenization regulations, issuing guidance papers, and adopting a “same activity, same risk” approach. |

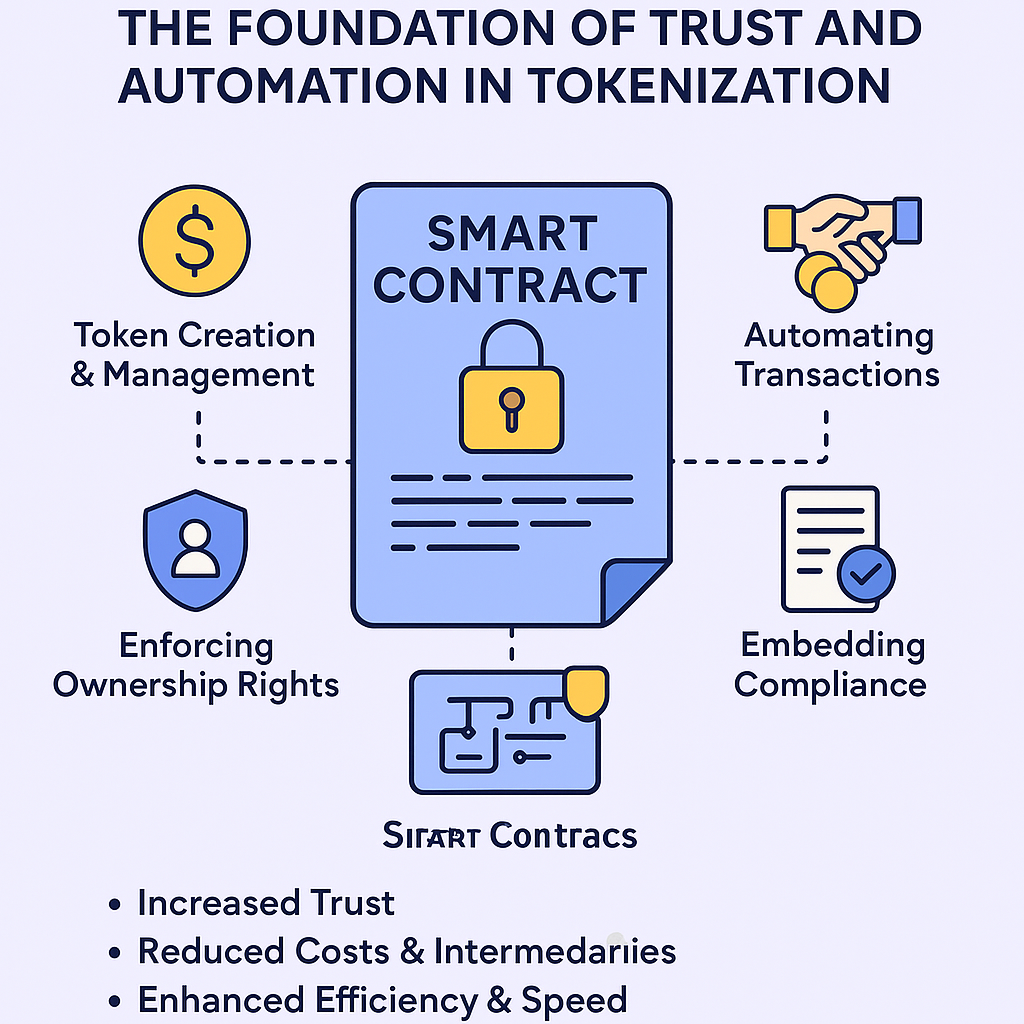

5. Smart Contracts: The Foundation of Trust and Automation in Tokenization

Smart contracts are a cornerstone of real-world asset tokenization, acting as self-executing agreements written directly into code on the blockchain. These contracts automatically enforce the terms and conditions of an agreement without the need for intermediaries. They play a vital role in various aspects of the tokenization process, including token creation and management by defining the token’s properties, supply, and ownership. Smart contracts are also crucial for enforcing ownership rights by representing and managing the ownership of the underlying asset on the blockchain.

Furthermore, smart contracts enable automating transactions by facilitating peer-to-peer transfers of tokenized assets without the need for traditional intermediaries. They can also be programmed to enforce compliance by embedding KYC/AML and other regulatory requirements directly into the code, ensuring that only eligible participants can hold or trade certain tokenized assets. Additionally, smart contracts can automate various aspects of asset management , such as the distribution of dividends or rental income to token holders, and even handle governance rights. In some cases, smart contracts can act as escrow agents , holding assets until predefined conditions are met, and even define processes for dispute resolution.

The use of smart contracts in RWA tokenization offers several key benefits. They increase trust due to their transparency and immutability, as all transactions and contract terms are recorded on the blockchain and cannot be altered. They also lead to reduced costs and intermediaries by automating processes that traditionally require human intervention and third-party services. This automation also results in enhanced efficiency and speed in various processes, from asset transfers to dividend payments. Finally, smart contracts contribute to improved security through the cryptographic enforcement of the rules embedded in the code.

Q&A with Blockchain Expert:

Blog Author: “So, the smart contract is like the rulebook for my tokenized asset? What happens if there’s a mistake in the code?”

Expert Response: “That’s a good analogy. And you’re right, errors in smart contract code can have serious consequences. That’s why rigorous security audits and testing are absolutely crucial before deploying a smart contract.”

6. Building the Digital Agreement: Creating and Validating Smart Contracts for RWAs

Creating and validating smart contracts for tokenized real-world assets is a critical process that requires careful attention to detail and security. The process typically begins with defining token specifications , clearly outlining the token’s purpose, features, and the rules governing its behavior. Next, an appropriate blockchain platform that supports smart contracts, such as Ethereum, Solana, or Hedera, is chosen based on the project’s requirements. The smart contract code is then written using programming languages like Solidity for Ethereum.

Once the code is developed, thorough testing on test networks is essential to identify and fix any bugs or vulnerabilities before deployment on the main network. A crucial step in ensuring the security and reliability of smart contracts is security auditing. This involves engaging third-party experts to review the code for potential vulnerabilities through both manual analysis and automated tools. Auditors look for common vulnerabilities such as reentrancy attacks, integer overflows, and frontrunning. Verification is another important aspect, ensuring that the bytecode deployed on the blockchain matches the source code that was audited. Finally, after rigorous testing and auditing, the smart contract is ready for deployment to the mainnet.

Several security considerations are paramount when creating smart contracts for RWA tokenization. Following secure coding practices is essential to minimize the risk of vulnerabilities. Implementing proper access controls ensures that only authorized entities can perform specific actions. Utilizing secure and well-tested libraries like OpenZeppelin can significantly enhance the security and reliability of the contracts. Regularly updating and patching contracts, if the design allows, can help mitigate newly discovered risks. Lastly, proper management of private keys is crucial for securing the accounts that control the smart contracts and the underlying assets.

Q&A with Blockchain Expert:

Blog Author: “How do I know if a smart contract is safe? What should I look for?”

Expert Response: “Look for publicly available security audit reports from reputable firms. These reports detail any vulnerabilities found and whether they have been addressed. Also, check if the contract source code has been verified on the blockchain, which ensures transparency.”

7. Taking Your Assets On-Chain: A Practical Guide to Tokenizing a Physical Asset

For individuals looking to tokenize a physical asset, a structured approach is essential. The very first step is to ensure legal and regulatory compliance. This involves determining the legal classification of your asset in your specific jurisdiction and understanding the applicable securities laws and other relevant regulations. Consulting with legal professionals who specialize in blockchain and asset tokenization is highly recommended to navigate this complex landscape.

Next, you will need to obtain a professional and potentially independent asset valuation to accurately determine the worth of your physical asset. This valuation will be crucial for determining the number of tokens to issue and their initial price. You will then need to research and select a tokenization platform or service provider that offers the necessary tools and expertise for RWA tokenization. Consider factors such as fees, the blockchain platforms they support, their compliance features, and their overall user experience.

While not always mandatory, creating a legal entity , such as an SPV, to hold the asset is often recommended as it can help isolate the asset from personal liabilities and provide a clear ownership structure for token holders. You will also need to define the tokenomics of your token, deciding on the total number of tokens, the level of fractionalization you want to offer, and any specific rights or benefits that will be associated with holding the tokens.

The process of developing and deploying smart contracts will be a crucial technical step. Unless you have the necessary expertise, you will likely need to rely on your chosen platform or hire smart contract developers. You will also need to consider custody solutions for your physical asset, ensuring it is securely stored and managed. Finally, you will need to develop a plan for marketing and distribution to make your tokens available to potential investors, as well as establish processes for ongoing management and reporting to keep token holders informed about the asset’s performance and any relevant updates.

Q&A with Blockchain Expert:

Blog Author: “Okay, say I want to tokenize my rare vintage car. What’s the very first thing I should do?”

Expert Response: “The absolute first step is to understand the legal implications in your location. Is your token going to be considered a security? You’ll need to consult with a lawyer to figure that out before you do anything else.”

Table: Steps to Tokenize a Physical Asset

| Step | Description |

| Legal and Regulatory Compliance | Understand and adhere to all relevant laws and regulations in your jurisdiction. |

| Asset Valuation | Obtain a professional and accurate valuation of your physical asset. |

| Platform/Service Provider Selection | Choose a suitable platform or service provider that offers RWA tokenization services. |

| Creating a Legal Entity (Recommended) | Set up an SPV or similar structure to hold the asset. |

| Defining Tokenomics | Decide on the number of tokens, fractionalization, and associated rights. |

| Smart Contract Development & Deployment | Create and deploy the smart contracts that will govern your tokens. |

| Custody Solutions | Determine how your physical asset will be securely stored and managed. |

| Marketing and Distribution | Plan how you will offer your tokens to potential investors. |

| Ongoing Management and Reporting | Establish processes for managing the asset and providing updates to token holders. |

8. The Power of the Ledger: How Blockchain Ensures Security and Transparency

Blockchain technology is the backbone that provides the security and transparency essential for the success of real-world asset tokenization. Its decentralized nature, where data is distributed across a network of computers, reduces the risk of a single point of failure and makes censorship attempts extremely difficult. The immutability of the blockchain, meaning that once a transaction is recorded it cannot be altered , ensures the integrity and reliability of ownership records.

Furthermore, blockchain offers a high degree of transparency , as transaction and ownership records are typically publicly viewable on the blockchain. This allows for easy verification and builds trust among participants. Cryptography plays a crucial role in securing transactions and verifying ownership through the use of digital signatures and encryption.

To further enhance the transparency and verifiability of tokenized assets, especially those backed by off-chain reserves, mechanisms like Proof of Reserve (PoR) are often employed. PoR uses oracles to provide cryptographic evidence that the number of tokens issued on the blockchain is matched by the equivalent amount of the underlying asset held in custody. This helps to ensure that the digital representation accurately reflects the real-world asset it represents.

Q&A with Blockchain Expert:

Blog Author: “How can I be sure that the digital token actually represents the real asset? What’s stopping someone from just creating tokens out of thin air?”

Expert Response: “This is where concepts like Proof of Reserve come in. These mechanisms use oracles to cryptographically verify that the number of tokens issued matches the amount of the underlying asset held in custody. This provides a strong level of assurance.”

9. Navigating the Challenges: Risks and Considerations in RWA Tokenization

While real-world asset tokenization offers numerous benefits, it is also important to be aware of the potential challenges and risks involved. Regulatory uncertainty remains a significant challenge as the legal landscape continues to evolve and lacks global standardization. The valuation complexity of accurately appraising a wide variety of real-world assets can also pose difficulties.

Despite the inherent security of blockchain, security risks to smart contracts and tokenization platforms still exist and need to be carefully addressed through rigorous security audits and best practices. Custodial risks associated with the secure storage and management of the underlying physical assets are also a crucial consideration. Furthermore, incompatibility with traditional systems can create challenges when trying to integrate tokenized assets with existing financial and legal infrastructure.

While tokenization aims to enhance liquidity, market liquidity risks can still exist, especially in the early stages of adoption. Counterparty risk, which is the risk associated with the entities involved in the tokenization process, also needs to be carefully evaluated. Finally, establishing clear governance issues and mechanisms for tokenized assets can be complex and requires careful planning.

Q&A with Blockchain Expert:

Blog Author: “What are some of the biggest potential pitfalls I should be aware of if I’m considering investing in or tokenizing an asset?”

Expert Response: “Regulatory uncertainty is a big one. You need to be sure you’re operating within the legal boundaries. Also, the actual value of the underlying asset and the security of the smart contracts are critical. Do your due diligence on both.”

The Takeaway: The Future of Asset Ownership

Real-world asset tokenization represents a paradigm shift in how we think about and interact with valuable assets. By bridging the gap between the physical and digital worlds, tokenization unlocks a multitude of benefits, including increased liquidity, fractional ownership, enhanced transparency, and operational efficiency. Its potential applications across various industries are vast, promising to democratize access to investment opportunities and reshape financial markets.

However, it is crucial to approach this evolving sector with a thorough understanding of the processes, governance, and inherent risks involved. Navigating the legal and regulatory landscape, ensuring the security of smart contracts, and accurately valuing diverse assets are just some of the challenges that need careful consideration. As blockchain technology continues to mature and regulatory frameworks become clearer, real-world asset tokenization is poised to play an increasingly significant role in the future of asset ownership, offering a more inclusive, efficient, and transparent way to manage and trade value.

Glossary of Key Terms

- Real-World Asset (RWA): A physical or tangible asset that exists in the real world, such as real estate, commodities, art, or financial instruments.

- Tokenization: The process of converting the ownership rights of an asset into digital tokens on a blockchain.

- Digital Token: A digital representation of an asset or a right, recorded on a blockchain.

- Blockchain: A decentralized, distributed ledger technology that records transactions across many computers in a secure and transparent way.

- Fungible Token: A type of digital token that is interchangeable with other tokens of the same type and value (e.g., one token equals another).

- Non-Fungible Token (NFT): A unique and indivisible type of digital token that represents ownership of a specific asset (e.g., a piece of art).

- Liquidity: The ease with which an asset can be bought or sold without causing a significant change in its price.

- Fractional Ownership: Dividing the ownership of a high-value asset among multiple individuals, making it more affordable and accessible.

- Transparency: The quality of being open and having information readily available, often referring to the auditable nature of blockchain transactions.

- Smart Contract: A self-executing agreement written in code and stored on a blockchain, which automatically enforces the terms and conditions when predefined conditions are met.

- Decentralized Finance (DeFi): A financial system built on blockchain technology that aims to be open, permissionless, and accessible to everyone, without the need for traditional intermediaries.

- Custody: The secure storage and management of assets, whether physical or digital.

- Tokenomics: The economics of a token, including its creation, distribution, supply, and how it functions within an ecosystem.

- Regulatory Compliance: Adhering to the laws, rules, and regulations set forth by governing bodies.

- Anti-Money Laundering (AML): A set of procedures, laws, and regulations designed to prevent the generation of income from illegal activities.

- Know Your Customer (KYC): The process of verifying the identity of customers to prevent illegal activities.

- Security Token: A digital token that represents ownership in an asset, such as equity or debt, and is subject to securities regulations.

- Proof of Reserve (PoR): A cryptographic method used to verify that a custodian of assets holds the amount of assets they claim to hold.

- Oracle: A third-party service that provides external data to blockchain smart contracts.

- Tokenized Special Purpose Vehicle (SPV): A legal entity created for a specific purpose, in this case, holding an asset that is being tokenized.

- Minting: The process of creating new digital tokens on a blockchain.

- Immutability: The property of a blockchain where once data is recorded, it is very difficult or practically impossible to alter or delete.

- Asset Valuation: The process of determining the current worth of an asset.